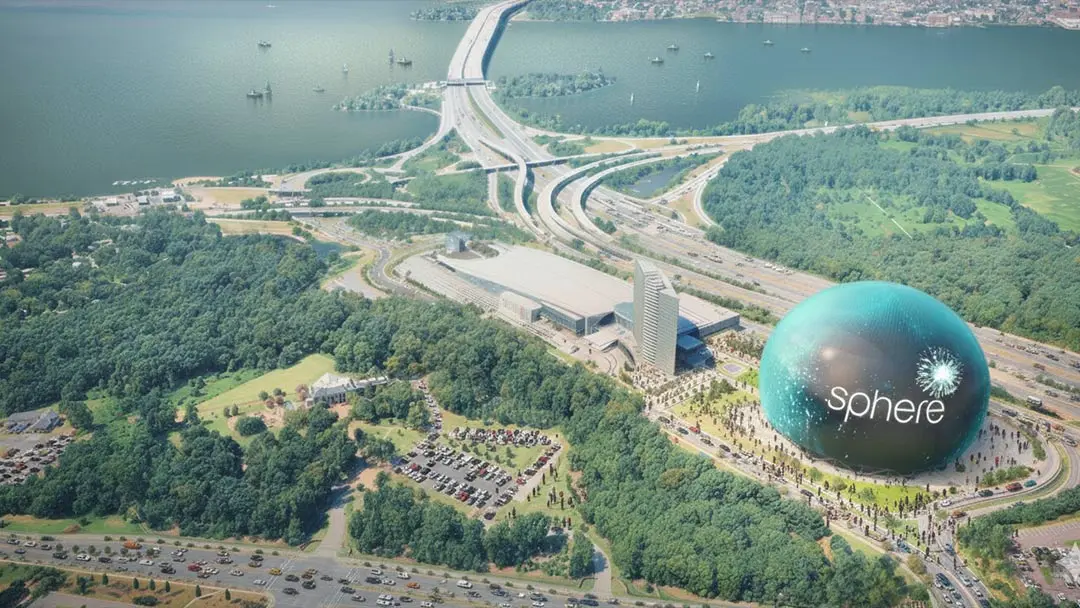

Sphere National Harbor

Sphere National Harbor

How will Prince George's County benefit from Sphere National Harbor?

Sphere National Harbor is estimated to provide $1.6 billion in economic benefits to Prince George’s County during the construction period alone, including 3,350 full- and part-time construction-related jobs.

Once operational, the total annual economic impact from Sphere National Harbor to Prince George’s County from operations and visitor spending at hotels, restaurants, stores and other local venues in the County is estimated at more than $1.3 billion per year – and another $200 million for other parts of Maryland. Sphere is estimated to directly and indirectly support approx. 7,100 full- and part-time positions in Prince George’s County alone.

Projected Economic Benefits of Sphere National Harbor

$1.6 billion

Economic benefits from construction

$1.3 billion+

Total annual economic impact once operational

$63 million

Annual taxes paid to Prince George’s County

Projected Benefits At-A-Glance

Source: Ernst & Young LLP

What is a TIF?

Tax Increment Financing

“A smart way to do public investment” -County Executive Aisha N. Braveboy

Tax Increment Financing or a TIF has been used in 48 states and the District of Columbia to leverage future community improvement projects and spur economic growth. When a development or redevelopment project is going to create additional tax revenues for a jurisdiction that jurisdiction can, in certain cases, issue bonds funded by private investors to pay for a portion of that project. The bonds are repaid through the future, new tax revenue that the project will generate. This form of support does not use any existing tax dollars and will not cost county taxpayers a dime in additional taxes. Most of the new revenue is not needed to repay the bonds and goes to the jurisdiction and when the bonds are repaid, all revenues are paid to the jurisdiction.

National Harbor originally was developed using TIF. It is a finance tool used by local governments across Maryland and across the country to attract private investment for development projects by leveraging future tax income. It is not a new tax or a tax increase. Other examples include Woodmore Town Center along with projects in Annapolis, Frostburg and elsewhere.

Prince George’s County competed against other locations in the region for the opportunity to have Sphere at National Harbor. In addition to having a prime location and knowing that the Sphere would result in significant new jobs, tax revenue and economic activity, we put together an attractive package of compelling, yet responsible, incentives. Foremost among these was the use of economic development bonds in the form of a TIF.